In the vast world of foreign exchange (Forex), traders navigate a multitude of currency pairs, each presenting unique characteristics and trading opportunities. Identifying the most popular currency pairs among traders is crucial for understanding market dynamics and optimizing trading strategies.

This article delves into the world of Forex, shedding light on the currency pairs that reign supreme in terms of liquidity, volatility, and global recognition. Discover the factors that influence their popularity and how traders can leverage market insights to make informed trading decisions.

Understanding the Popularity of Currency Pairs in Forex

The Big Players: Major Currency Pairs

Major currency pairs are the most traded in the Forex market due to their high liquidity and volatility. They are made up of the currencies of the world’s largest economies.

Here are some of the most popular major pairs:

| Currency Pair | Description |

|---|---|

| EUR/USD | Euro against US Dollar |

| USD/JPY | US Dollar against Japanese Yen |

| GBP/USD | British Pound against US Dollar |

| AUD/USD | Australian Dollar against US Dollar |

| USD/CHF | US Dollar against Swiss Franc |

Trading the Crosses: Minor Currency Pairs

Minor currency pairs, also known as crosses, involve the currencies of two countries that are not the US.

These pairs can offer potential for higher profits due to their increased volatility, but they also come with higher risk.

| Currency Pair | Description |

|---|---|

| EUR/JPY | Euro against Japanese Yen |

| GBP/JPY | British Pound against Japanese Yen |

| AUD/NZD | Australian Dollar against New Zealand Dollar |

| EUR/GBP | Euro against British Pound |

| EUR/CHF | Euro against Swiss Franc |

Exotic Pairs: For the Experienced Trader

Exotic currency pairs involve the currencies of one major economy and one emerging market economy. These pairs offer unique trading opportunities but are generally less liquid and more volatile than major or minor pairs.

| Currency Pair | Description |

|---|---|

| USD/TRY | US Dollar against Turkish Lira |

| USD/ZAR | US Dollar against South African Rand |

| EUR/PLN | Euro against Polish Zloty |

| GBP/INR | British Pound against Indian Rupee |

| USD/RUB | US Dollar against Russian Ruble |

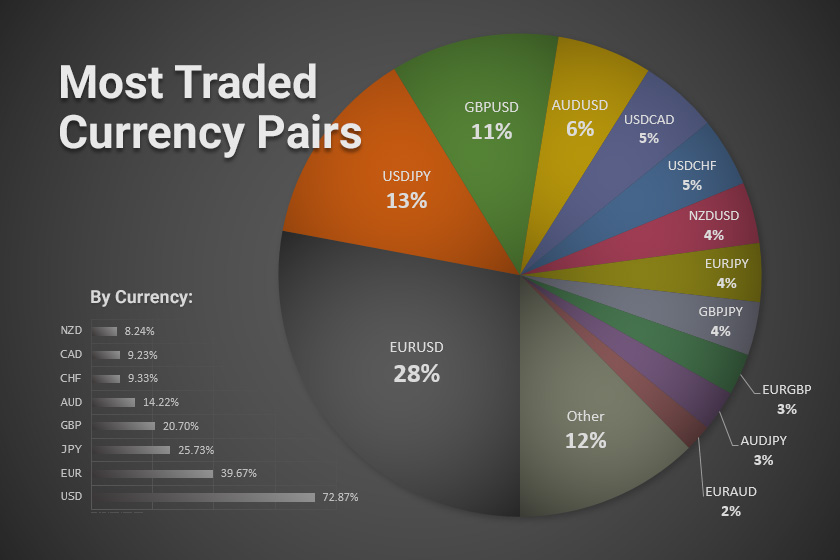

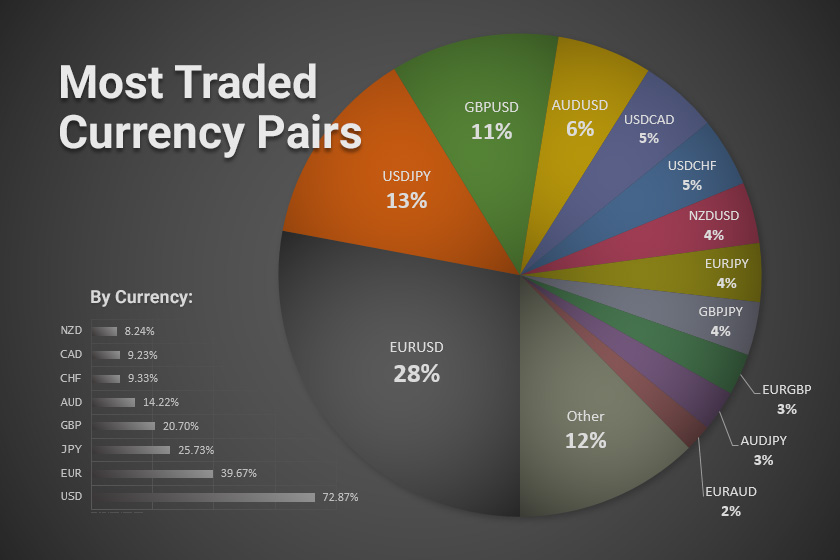

What are the most traded currency pairs in the forex market?

The Majors

The most traded currency pairs in the forex market are known as "majors" and consist of the currencies of the world’s largest economies. These pairs typically have the highest trading volume and liquidity, making them attractive to both retail and institutional traders.

- EUR/USD (Euro/US Dollar): The Euro is the second most traded currency globally, making this pair the most popular in forex trading. Its popularity stems from the Eurozone’s significant economic influence and the US Dollar’s role as the world’s reserve currency.

- USD/JPY (US Dollar/Japanese Yen): The Japanese Yen is known for its safe-haven status, making this pair attractive during times of market uncertainty.

- GBP/USD (British Pound/US Dollar): The British Pound is the world’s fourth most traded currency, making this pair a popular choice for traders.

- USD/CHF (US Dollar/Swiss Franc): The Swiss Franc is another safe-haven currency, attracting traders seeking to reduce risk.

- AUD/USD (Australian Dollar/US Dollar): The Australian Dollar is heavily influenced by commodity prices, making this pair attractive to traders looking to capitalize on commodity price movements.

- NZD/USD (New Zealand Dollar/US Dollar): Like the Australian Dollar, the New Zealand Dollar is also influenced by commodity prices and interest rate differentials.

- USD/CAD (US Dollar/Canadian Dollar): The Canadian Dollar is closely linked to oil prices, making this pair popular among traders seeking to profit from oil price movements.

The Minors

The "minors" in forex trading refer to currency pairs that involve one major currency and one currency from a smaller economy. While they generally have less trading volume than the majors, they can offer attractive opportunities for traders looking for higher volatility and potential profit.

- EUR/GBP (Euro/British Pound)

- EUR/JPY (Euro/Japanese Yen)

- GBP/JPY (British Pound/Japanese Yen)

- AUD/JPY (Australian Dollar/Japanese Yen)

- NZD/JPY (New Zealand Dollar/Japanese Yen)

- USD/SEK (US Dollar/Swedish Krona)

- USD/NOK (US Dollar/Norwegian Krone)

Exotic Pairs

Exotic pairs are currency pairs that involve two currencies from emerging markets or less developed economies. These pairs often have lower liquidity and higher volatility, making them more risky but also potentially more profitable for experienced traders.

- USD/TRY (US Dollar/Turkish Lira)

- USD/ZAR (US Dollar/South African Rand)

- USD/MXN (US Dollar/Mexican Peso)

- USD/BRL (US Dollar/Brazilian Real)

- USD/RUB (US Dollar/Russian Ruble)

What is the best currency pairs to trade in forex?

The Best Forex Currency Pairs to Trade

There is no single "best" currency pair to trade in Forex as the best pair for you will depend on your individual trading style, risk tolerance, and market outlook. However, some pairs are generally considered to be more popular and liquid, offering more trading opportunities and potentially higher returns. Here are some of the most traded currency pairs in the Forex market, each with its own unique characteristics and volatility:

Major Currency Pairs

Major currency pairs involve the US dollar (USD) paired with another major currency, such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Australian dollar (AUD), and Canadian dollar (CAD). These pairs typically have the highest liquidity and the tightest spreads, making them attractive for both beginner and experienced traders.

- EUR/USD: The euro-US dollar pair is the most traded currency pair globally, offering high liquidity and volatility. It’s known for its sensitivity to economic data releases and political events in Europe and the US.

- USD/JPY: The US dollar-Japanese yen pair is considered a safe-haven asset during times of global uncertainty. Its price movements are often influenced by risk aversion and global economic conditions.

- GBP/USD: The British pound-US dollar pair is known for its volatility and is often affected by UK economic data and political developments.

Minor Currency Pairs

Minor currency pairs involve the US dollar paired with a currency of a smaller economy, such as the New Zealand dollar (NZD), South African rand (ZAR), or Mexican peso (MXN). These pairs typically have lower liquidity and wider spreads compared to major pairs but can offer higher potential returns.

- USD/NZD: The US dollar-New Zealand dollar pair is known for its sensitivity to global risk sentiment and commodity prices, as New Zealand is a major exporter of dairy and agricultural products.

- USD/ZAR: The US dollar-South African rand pair is often influenced by commodity prices, as South Africa is a major producer of gold and platinum. It is also considered a high-volatility pair.

- USD/MXN: The US dollar-Mexican peso pair is significantly influenced by the North American Free Trade Agreement (NAFTA) and the performance of the US economy.

Exotic Currency Pairs

Exotic currency pairs involve the US dollar paired with currencies of emerging markets, such as the Turkish lira (TRY), Russian ruble (RUB), or Hungarian forint (HUF). These pairs have the lowest liquidity and widest spreads among the three types but can offer unique trading opportunities and high potential returns.

- USD/TRY: The US dollar-Turkish lira pair is known for its high volatility and is often influenced by political developments and economic conditions in Turkey.

- USD/RUB: The US dollar-Russian ruble pair is often influenced by global oil prices and political events in Russia.

- USD/HUF: The US dollar-Hungarian forint pair is known for its high volatility and is often influenced by economic data and interest rate decisions in Hungary.

Which forex pairs trend the most?

Which Forex Pairs Trend the Most?

It’s hard to definitively say which forex pairs trend the most as this can change based on market conditions. However, some pairs are generally known for having stronger trends than others due to various factors like fundamental news releases, volatility, and trading volume. Here are some of the forex pairs that are commonly recognized for their tendency to trend:

Major Pairs

Major pairs are those that involve the US dollar and another major currency. They are the most actively traded pairs and tend to have more significant trends. This is because they are influenced by the global economic conditions and political factors, making them highly sensitive to news releases and events.

- EUR/USD: The Euro against the US Dollar is one of the most traded pairs in the world and often exhibits clear trends, especially in response to news from the European Central Bank (ECB) and the Federal Reserve.

- GBP/USD: The British Pound Sterling against the US Dollar is also highly traded and often sees notable trends. The Bank of England’s monetary policy decisions, UK economic data releases, and political developments significantly impact this pair.

- USD/JPY: The US Dollar against the Japanese Yen is known for its tendency to trend, particularly during periods of global risk aversion. This is due to the yen’s status as a safe-haven currency, leading to increased demand for the yen during times of uncertainty.

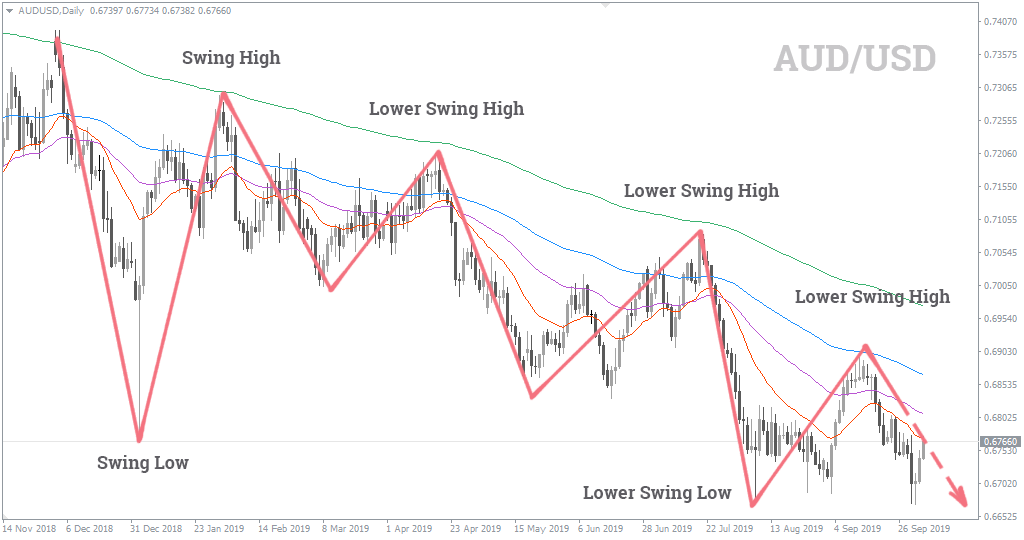

Commodity Pairs

Pairs involving currencies closely tied to commodity prices, such as oil or gold, often display strong trends. This is because the price fluctuations of these commodities can significantly influence their respective currencies.

- USD/CAD: The US Dollar against the Canadian Dollar is influenced by the price of oil, as Canada is a major oil exporter. Oil price movements directly impact the Canadian economy and its currency.

- AUD/USD: The Australian Dollar against the US Dollar is also affected by commodity prices, particularly those of gold and iron ore. Australia is a leading exporter of these commodities, making its currency vulnerable to their price fluctuations.

Cross Pairs

Cross pairs involve two currencies that are not the US Dollar. These pairs can also exhibit strong trends, often driven by economic divergences between the two countries involved.

- EUR/GBP: The Euro against the British Pound Sterling is a popular cross pair that often displays notable trends, particularly during periods of divergent economic policies between the European Union and the United Kingdom.

- AUD/NZD: The Australian Dollar against the New Zealand Dollar is a cross pair that can be influenced by factors such as commodity prices and interest rate differentials between the two countries.

What are the most ranging pairs in forex?

What are ranging pairs?

Ranging pairs in forex are currency pairs that tend to move within a defined price range for a significant period. They are characterized by low volatility and exhibit limited price swings. These pairs are often preferred by traders who favor scalping or day trading strategies, where they attempt to capitalize on small price fluctuations within the established range.

Identifying Ranging Pairs

Determining whether a currency pair is ranging involves analyzing its recent price history. Here are some key indicators:

- Limited price movement: The price of a ranging pair often stays within a specific range, with minimal breakthroughs beyond the defined boundaries.

- Presence of support and resistance levels: Ranging pairs typically show clear support and resistance levels, which act as price boundaries, preventing significant price fluctuations.

- Low volatility: Volatility is a key factor in identifying ranging pairs. Low volatility indicates that price movements are relatively small and predictable, making it easier to trade within a defined range.

Common Ranging Pairs

While the specific pairs that exhibit ranging behavior can fluctuate over time, certain currencies are known for their tendency to trade in ranges. Some common ranging pairs include:

- USD/JPY: The US dollar-Japanese yen pair is often considered a ranging pair, particularly during periods of economic stability. Its relatively low volatility and tendency to move within a defined range make it attractive for scalpers and day traders.

- EUR/USD: The euro-US dollar pair, while considered a major currency pair, can also exhibit ranging characteristics, especially during periods of low economic uncertainty.

- GBP/USD: The British pound-US dollar pair, although known for its volatility, can display ranging characteristics during periods of low political and economic instability.

Frequently Asked Questions

What are the most popular currency pairs in Forex?

The most popular currency pairs in Forex are known as major currency pairs. These pairs are the most traded in the market and have the highest liquidity. The major currency pairs are:

- EUR/USD (Euro against US Dollar)

- USD/JPY (US Dollar against Japanese Yen)

- GBP/USD (British Pound Sterling against US Dollar)

- USD/CHF (US Dollar against Swiss Franc)

- AUD/USD (Australian Dollar against US Dollar)

- NZD/USD (New Zealand Dollar against US Dollar)

- USD/CAD (US Dollar against Canadian Dollar)

These currency pairs are popular because they are traded in large volumes, have low transaction costs, and are relatively easy to understand.

Why are the major currency pairs the most popular?

The major currency pairs are the most popular in Forex for several reasons:

- High liquidity: They are traded in large volumes, meaning there are always buyers and sellers available, ensuring you can enter and exit trades quickly and easily.

- Low transaction costs: The high volume of trading leads to lower spreads, the difference between the buying and selling price.

- Ease of understanding: They are typically the most stable currency pairs, making them easier to understand and analyze.

- Wider availability: Most Forex brokers offer trading in all the major currency pairs.

These factors make the major currency pairs an attractive choice for both new and experienced traders.

What are the benefits of trading the most popular currency pairs?

There are numerous benefits to trading the most popular currency pairs, including:

- Lower risk: The high liquidity and stability of major pairs can help minimize risk for traders.

- More trading opportunities: High volume leads to more frequent price movements, increasing potential trading opportunities.

- Easier to learn: With more available information and analysis, the major pairs are easier to understand and trade for beginners.

- Better price execution: With more market participants, you can expect better price execution when entering and exiting trades.

These advantages make the major currency pairs a popular choice for traders of all levels of experience.

Are there any disadvantages to trading the most popular currency pairs?

While the major currency pairs offer many benefits, there are also some drawbacks:

- Higher competition: The popularity of major pairs can lead to increased competition amongst traders.

- Less potential for high gains: The stability of major pairs can also mean smaller price swings, limiting the potential for significant profits.

- More susceptible to market news: Due to their high volume and influence, major pairs are more reactive to economic news and events, which can cause large and sudden price movements.

Despite these potential downsides, the advantages of trading the major currency pairs still outweigh the disadvantages for many traders.