Navigating the complexities of the Forex market requires not only an understanding of fundamental and technical analysis but also an awareness of the most opportune times to execute trades. By identifying periods of high volatility and liquidity, traders can increase their chances of success. This article delves into the most important trading hours in the Forex market, examining the factors that influence market activity and providing actionable insights for traders seeking to optimize their returns.

Optimal Trading Hours in the Forex Market

Understanding Forex Market Liquidity

The Forex market is a 24-hour, 5-day-a-week market, but not all hours are created equal. The concept of liquidity is crucial in understanding the best times to trade Forex. Liquidity refers to the ease with which you can buy or sell a currency pair. The more traders active in the market, the higher the liquidity. High liquidity means tight spreads, quick order execution, and less risk of slippage.

Key Trading Sessions and Overlap Periods

| Session | Time (GMT) | Key Features |

|---|---|---|

| London Session | 08:00 – 17:00 | – High volume and volatility – Overlap with Tokyo Session – Major economic data releases |

| New York Session | 13:00 – 22:00 | – Highest volume and volatility – Overlap with London Session – Significant US economic releases |

| Tokyo Session | 23:00 – 08:00 | – Moderate volume and volatility – Overlap with London Session – Focus on Asian economic data |

Trading Strategies for Optimal Times

The optimal time to trade Forex depends on your individual trading style and risk tolerance. Some common strategies include:

– Scalping: This high-frequency strategy focuses on small profits during high-volatility periods like the London and New York sessions overlap.

– Day Trading: This strategy involves holding trades for a few hours, often targeting price fluctuations within a single trading session.

– Swing Trading: This strategy involves holding trades for a few days to a few weeks, capitalizing on longer-term trends.

What are the best times to trade forex?

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

The London Session (GMT 8:00 AM to 4:00 PM)

The London session is generally considered the busiest and most volatile session for forex trading. This is because London is a major financial hub and many institutional investors are active during this time. The high trading volume and volatility can create opportunities for profitable trades, but also increase the risk of losses.

- High Liquidity: This session is characterized by high liquidity, meaning that there are many buyers and sellers in the market, which makes it easier to enter and exit trades.

- Increased Volatility: The high trading volume during the London session often leads to price fluctuations, making it a favorable environment for scalping strategies.

- Overlap with other Sessions: The London session overlaps with the New York session, resulting in a longer trading window with increased market activity and greater opportunities.

The New York Session (GMT 1:00 PM to 9:00 PM)

The New York session is the second most active forex session, as it’s when many US-based institutional investors and traders are active. This session often sees significant price movements, particularly in USD-related pairs, and is another good time to find trading opportunities.

- High Volume and Volatility: The New York session sees a considerable volume of trades, especially in USD pairs, which often translates to higher volatility and the potential for profitable trades.

- Key Economic Releases: This session frequently overlaps with important US economic releases, such as the Nonfarm Payrolls report, which can significantly impact market sentiment and currency pairs.

- Overlap with Other Sessions: The overlap with the London session can create a synergistic effect, with the combination of high trading volumes from both sessions contributing to greater volatility.

The Asian Session (GMT 11:00 PM to 7:00 AM)

The Asian session is often the least active of the three major sessions, but it can still be a good time to trade forex, particularly for traders who prefer a less volatile market.

- Lower Volatility: While the Asian session sees a lower trading volume compared to the London and New York sessions, it typically exhibits lower volatility, making it a more suitable environment for swing traders or those seeking more stable price movements.

- Economic Releases in Asian Countries: The Asian session may present opportunities to trade on economic news releases from key Asian economies, such as Japan, China, and Australia.

- Potential for Early Trends: The Asian session can sometimes set the tone for the rest of the day’s trading, offering the chance to identify trends early on.

What is the best time to make money in forex trading?

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

There is no "best" time to trade Forex

The forex market is open 24 hours a day, 5 days a week, and it is constantly moving. This means that there is no single "best" time to trade forex. The best time to trade forex is when the market is moving in your favor and when you have the time and energy to monitor your trades. That being said, some traders prefer to trade during certain periods of the day when the market is more active, such as during the European or US trading sessions.

Trading during periods of high volatility

Some traders prefer to trade during periods of high volatility, as this can lead to larger profits. However, it is important to note that high volatility can also lead to larger losses. If you are new to forex trading, it is best to start by trading during periods of low volatility. This will give you time to learn the ropes and develop a trading strategy without risking too much money.

- The London session: The London session is considered to be the most active trading session in the world. It starts at 8:00 am GMT and ends at 5:00 pm GMT. The London session is often characterized by high volatility, as traders from all over the world are active in the market.

- The New York session: The New York session is the second most active trading session in the world. It starts at 1:00 pm GMT and ends at 10:00 pm GMT. The New York session is often characterized by high volatility, as traders from the United States and Canada are active in the market.

- The Tokyo session: The Tokyo session is the least active trading session in the world. It starts at 7:00 pm GMT and ends at 4:00 am GMT. The Tokyo session is often characterized by low volatility, as traders from Japan and other Asian countries are active in the market.

Trading during periods of low volatility

Some traders prefer to trade during periods of low volatility, as this can lead to more stable profits. However, it is important to note that low volatility can also lead to smaller profits. If you are looking to make quick profits, it is best to trade during periods of high volatility. However, if you are looking to make steady profits over time, it is best to trade during periods of low volatility.

- The Asian session: The Asian session is often characterized by low volatility, as it is the least active trading session in the world. This is because the majority of the world’s major financial centers are closed during this time.

- The weekend: The forex market is closed on weekends, so there is no trading activity during this time.

What time of the day do you trade forex?

What are the best times to trade Forex?

The best times to trade Forex are during periods of high liquidity and volatility, when there is a lot of trading activity and the price of currency pairs is likely to fluctuate significantly. These periods generally coincide with the overlap of major trading sessions, as this is when the most traders are active.

- The London Trading Session (8:00 AM – 4:00 PM GMT) is often considered the most active session, as it overlaps with the US and Asia sessions.

- The New York Trading Session (1:00 PM – 9:00 PM GMT) is the second most active session, and often sees increased volatility as US economic data is released.

- The Tokyo Trading Session (6:00 PM – 2:00 AM GMT) is the least active session, but can see significant movement in the Yen pairs.

Why are the overlap times between sessions important?

The overlap times between trading sessions are important because they are when the most traders are active, leading to increased liquidity and volatility. This makes it easier to enter and exit trades, and also provides more opportunities for profit.

- High liquidity means that there are many buyers and sellers in the market, making it easier to find someone to trade with.

- High volatility means that prices are moving more quickly, which can lead to larger profits (or losses) for traders.

What are some other factors to consider when deciding when to trade Forex?

In addition to the overlap times between major trading sessions, there are a number of other factors that traders should consider when deciding when to trade Forex. These include:

- Your own trading style: Some traders prefer to trade during periods of high volatility, while others prefer to trade during calmer periods.

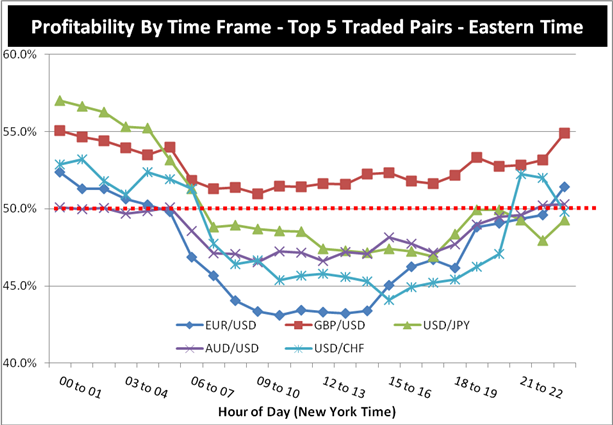

- The specific currency pairs you are trading: Some currency pairs are more volatile than others, and may be best traded during specific times of day.

- Economic news releases: Major economic news releases can have a significant impact on the Forex market, and it is important to be aware of these releases when deciding when to trade.

What are the best timeframes for forex day trading?

The Importance of Timeframes

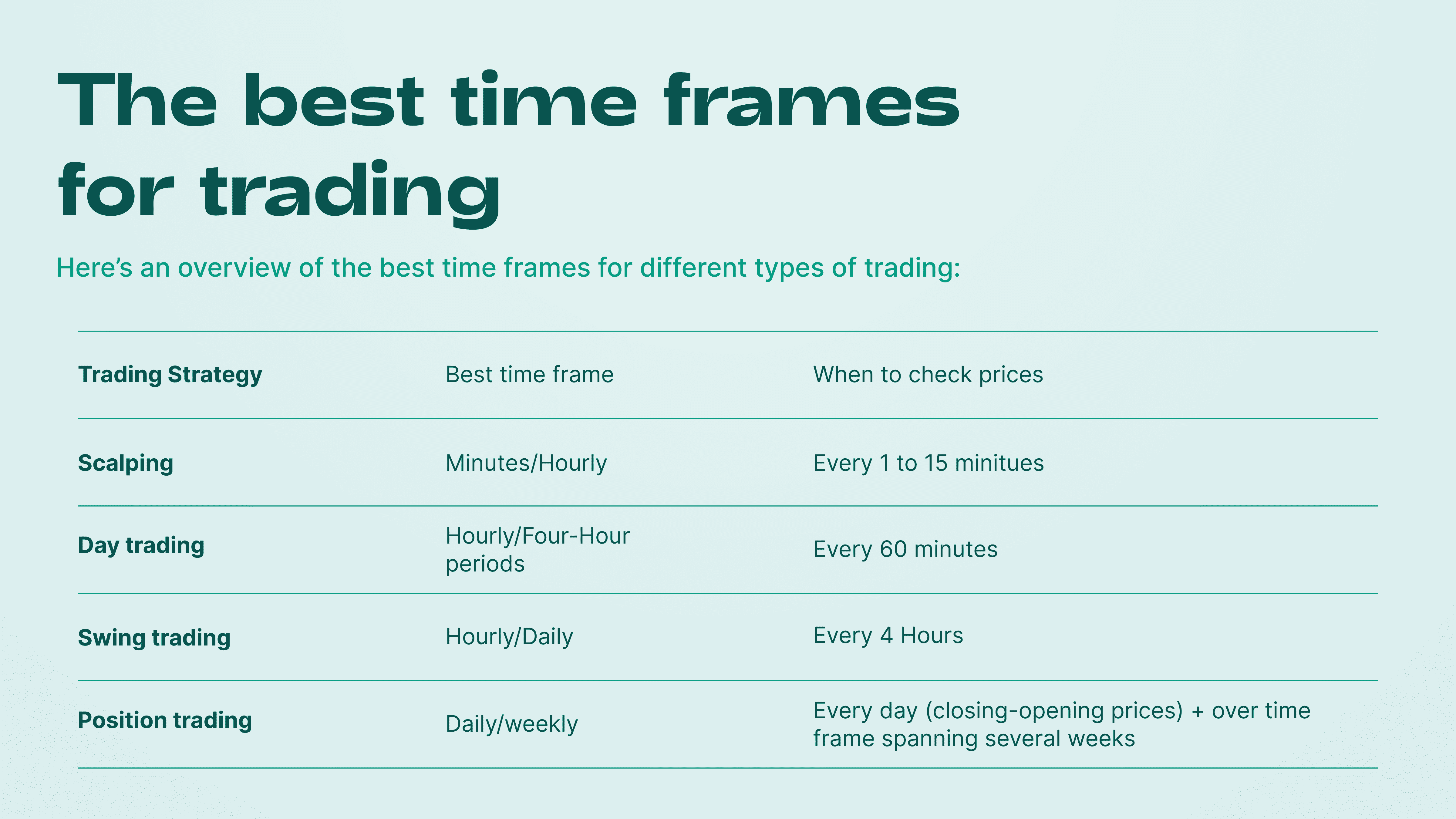

Choosing the right timeframe is crucial for Forex day trading. The timeframe you select will determine the trading strategy you use and the level of detail you will see in the price action. Some traders prefer to focus on short-term trends using shorter timeframes like 5 or 15 minutes, while others focus on longer-term trends using timeframes like 1 hour or 4 hours. The best timeframe for you will depend on your individual trading style, risk tolerance, and trading goals.

Popular Timeframes for Day Trading

- 5-minute chart: This timeframe is perfect for scalping, which is a trading strategy that aims to profit from small price fluctuations. Scalping requires a high level of concentration and speed, so it is not for everyone.

- 15-minute chart: The 15-minute timeframe offers a slightly longer view of the market than the 5-minute chart. It is a good choice for traders who are looking to capture momentum swings but do not want to be tied to their screens all day.

- 1-hour chart: The 1-hour timeframe is a good choice for day traders who prefer to focus on longer-term trends. This timeframe allows you to see the bigger picture of the market and identify key support and resistance levels.

- 4-hour chart: The 4-hour timeframe is a popular choice for swing traders. It provides a good balance between short-term and long-term market trends, allowing traders to identify potential breakouts and pullbacks.

Factors to Consider When Choosing Timeframes

There are several factors to consider when choosing the best timeframes for Forex day trading. These include:

- Your trading style: If you are a scalper, you will likely use shorter timeframes like 5 or 15 minutes. If you are a trend trader, you will likely use longer timeframes like 1 hour or 4 hours.

- Your risk tolerance: Shorter timeframes offer more trading opportunities, but they also come with a higher risk of losses. Longer timeframes offer fewer trading opportunities, but they are generally less risky.

- Your trading goals: Your trading goals will also influence your choice of timeframes. If you are looking to make quick profits, you will likely use shorter timeframes. If you are looking to build wealth over time, you will likely use longer timeframes.

- Market volatility: The volatility of the Forex market can also influence your choice of timeframes. During periods of high volatility, you may want to use shorter timeframes to take advantage of the rapid price movements. During periods of low volatility, you may want to use longer timeframes to wait for stronger price action.

Frequently Asked Questions

What are the most important times to trade Forex?

The most important times to trade Forex are during the overlap of major trading sessions. This is because there is higher liquidity and greater volatility during these periods, which can create more trading opportunities. The overlap of the London and New York sessions is particularly important, as it is when the majority of global trading activity takes place.

What are the best times to trade Forex?

The best times to trade Forex are during the peak of major trading sessions. These are the times when most market participants are active, which can lead to increased volatility and more trading opportunities. The peak of the London session (8:00 AM – 12:00 PM GMT) and the peak of the New York session (12:00 PM – 4:00 PM GMT) are generally considered to be the best times to trade Forex.

How do I find the best times to trade Forex?

The best way to find the best times to trade Forex is to monitor the market and observe trading activity. You can use a trading platform with a calendar of economic events to see when major news releases are scheduled. You can also use a forex trading simulator to practice trading during different times of day.

What are the best times to trade Forex for beginners?

If you are a beginner, it is best to start trading during the overlap of major trading sessions. This is when liquidity is higher and volatility is greater, which can make it easier to learn the basics of forex trading. You should also avoid trading during times of high volatility, such as the release of major economic news.