Selecting a reliable Forex broker is paramount for traders seeking success in the financial markets. With countless options available, it becomes imperative to approach the decision-making process with due diligence and consideration.

This comprehensive guide will delve into the essential factors to consider when choosing a Forex broker, empowering traders to make informed decisions and maximize their trading potential.

From assessing regulation and safety measures to evaluating trading conditions, platform features, and customer support, we will provide a thorough analysis of the key aspects that differentiate an exceptional Forex broker from the rest.

Finding the Right Forex Broker for Your Needs

1. Understand Your Trading Style and Needs

Before diving into the broker selection process, it’s crucial to understand your trading style and needs. This involves considering the following aspects:

- Your trading experience: Are you a beginner or an experienced trader?

- Your investment goals: What are your financial objectives and risk tolerance?

- Trading frequency: How often do you plan to trade?

- Trading strategies: What types of strategies do you prefer, and what technical indicators are important to you?

- Desired platform features: What specific features and tools are essential for your trading approach?

By clearly defining your trading preferences, you can narrow down the list of brokers that best align with your requirements.

| Factor | Description |

|---|---|

| Trading Experience | Beginners might prefer brokers with user-friendly platforms and educational resources, while experienced traders may prioritize advanced features and tools. |

| Investment Goals | Your goals, such as capital growth, income generation, or hedging, will influence your choice of trading instruments and risk management strategies. |

| Trading Frequency | Active traders may require brokers with lower trading fees and fast execution speeds, while less frequent traders might focus on other factors. |

| Trading Strategies | The types of strategies you employ will dictate the platform features and indicators you need. For example, scalpers require low latency and instant order execution. |

| Platform Features | Consider features like charting tools, technical analysis indicators, order types, and real-time market data. |

2. Evaluate Broker Reputation and Regulation

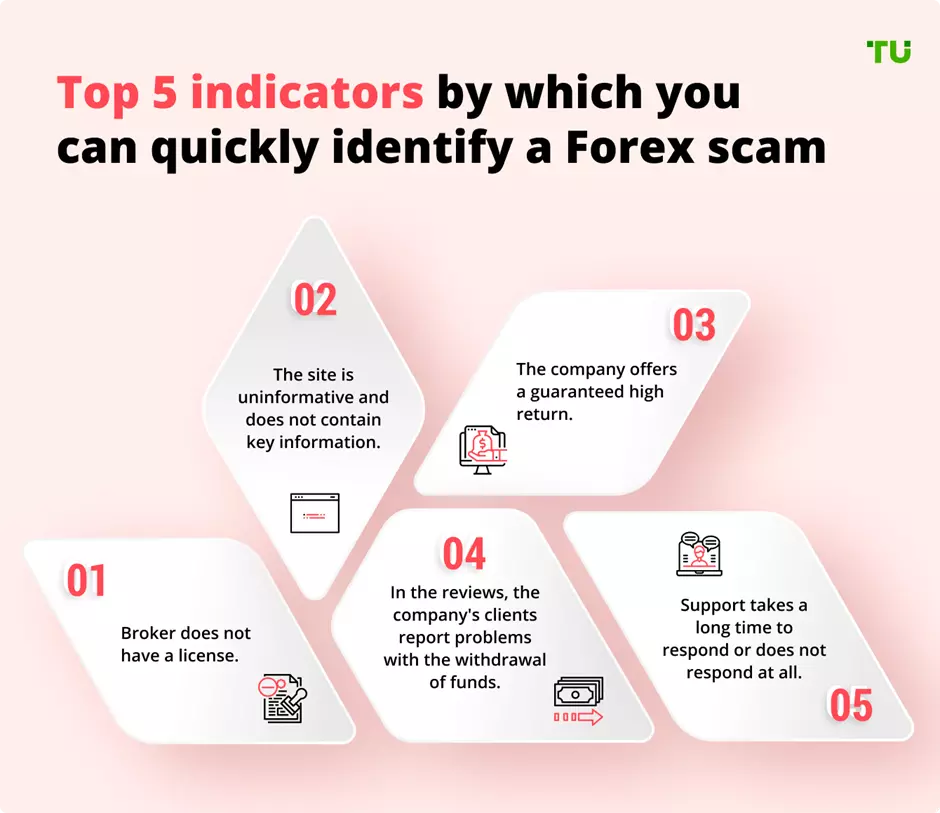

When choosing a Forex broker, it’s vital to prioritize reputation and regulation. A reputable and regulated broker ensures the safety of your funds and provides a trustworthy trading environment.

- Regulation: Look for brokers regulated by reputable financial authorities like the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the National Futures Association (NFA).

- Client reviews and testimonials: Research online reviews and forums to gauge the experiences of other traders.

- Transparency and accountability: Ensure the broker provides clear information about its fees, trading conditions, and risk disclosures.

By selecting a regulated and reputable broker, you can minimize the risks associated with fraudulent activities and ensure a secure trading experience.

| Factor | Description |

|---|---|

| Regulation | Regulation ensures brokers comply with industry standards and protect client funds. |

| Client Reviews and Testimonials | Real-life experiences of other traders offer valuable insights into the broker’s reliability and customer service. |

| Transparency and Accountability | Clear communication and transparency about fees, trading conditions, and risk disclosures foster trust and confidence. |

3. Compare Trading Conditions and Fees

Understanding the trading conditions and fees charged by different brokers is crucial to optimizing your profitability.

- Spreads: Compare the spreads offered by various brokers for your preferred trading instruments. Lower spreads generally result in better profitability.

- Commissions: Check if the broker charges commissions on trades, and if so, how they are structured.

- Leverage: While leverage can amplify profits, it also magnifies losses. Carefully consider your risk tolerance and choose an appropriate leverage level.

- Trading platforms: Evaluate the user-friendliness, features, and functionality of the platforms offered by different brokers.

- Customer support: Assess the availability and responsiveness of the broker’s customer support team.

Thoroughly comparing trading conditions and fees will help you identify brokers that provide the most competitive and transparent trading environment.

| Factor | Description |

|---|---|

| Spreads | Spreads represent the difference between the buying and selling prices of a currency pair. Lower spreads lead to higher profits. |

| Commissions | Commissions are fees charged per trade. Some brokers offer commission-free trading, while others charge a fixed or variable commission structure. |

| Leverage | Leverage allows traders to control larger positions with a smaller amount of capital. However, it also amplifies potential losses. |

| Trading Platforms | Platforms should be user-friendly, offer advanced charting tools, real-time market data, and a wide range of order types. |

| Customer Support | Responsive and reliable customer support is essential for resolving issues and obtaining assistance. |

How to choose a forex broker?

Choosing a Regulated Forex Broker

It’s crucial to choose a forex broker that is regulated by a reputable financial authority. This ensures that the broker is subject to certain rules and regulations that protect investors.

Look for brokers regulated by bodies like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the US. A regulated broker is more likely to be transparent, secure, and financially stable.

Evaluating Trading Platform Features and Functionality

The trading platform is your interface with the forex market. It’s essential to choose a platform that offers the features and functionality you need. Some key factors to consider include:

- User-friendliness: The platform should be easy to navigate and understand, even for beginners.

- Order types: Look for a platform that offers a variety of order types, such as market orders, limit orders, and stop-loss orders.

- Charting tools: A good platform will offer a range of technical indicators and charting tools to help you analyze market trends.

- Mobile compatibility: Being able to trade on the go is important, so ensure the platform has a robust mobile app.

Comparing Broker Fees and Spreads

Brokers charge fees for their services, which can vary significantly. It’s essential to compare the fees and spreads offered by different brokers.

- Spreads: The spread is the difference between the bid and ask price of a currency pair. Lower spreads mean lower trading costs.

- Commissions: Some brokers charge commissions on top of the spread. Make sure you understand the full cost of trading with each broker.

- Inactivity fees: Some brokers charge inactivity fees if you don’t trade for a certain period. Check if these fees apply.

What is the best broker to use for forex?

What factors to consider when choosing a forex broker

Choosing the right forex broker is crucial for a successful trading experience. Here are some key factors to consider:

- Regulation and Security: Opt for brokers regulated by reputable financial authorities like the FCA (UK), ASIC (Australia), or the NFA (USA). This ensures they adhere to strict standards, safeguarding your funds and protecting you from fraud.

- Trading Platform: A user-friendly and feature-rich trading platform is essential for smooth execution, order management, and analysis. Consider platforms offering real-time quotes, charting tools, and advanced technical indicators.

- Trading Conditions: Look for competitive spreads, leverage options, and a variety of order types that suit your trading style. Low spreads minimize trading costs, while leverage allows you to control larger positions with a smaller investment.

- Customer Support: Reliable customer support is crucial for addressing queries, resolving issues, and receiving guidance. Look for brokers with responsive support teams available through various channels, including phone, email, and live chat.

- Educational Resources: Many brokers offer educational resources, such as webinars, tutorials, and market analysis, to help traders learn and improve their skills. Consider whether these resources are valuable and relevant to your learning needs.

Types of Forex Brokers

Forex brokers can be categorized into different types, each with its own characteristics and advantages. Understanding these differences can help you choose the right broker for your trading needs.

- Market Makers: These brokers act as counterparties to your trades, meaning they execute orders directly against their own book. They typically offer tight spreads and fast execution but may have conflicts of interest.

- Ecn Brokers: Electronic communication network (ECN) brokers connect traders directly to liquidity providers, allowing for better pricing and transparency. They often have higher spreads but offer faster execution and less chance of slippage.

- STP Brokers: Straight-through processing (STP) brokers route orders directly to liquidity providers without intervention. This can result in more transparent pricing and execution, but execution speeds may vary depending on the liquidity provider.

Top Forex Brokers

While there is no single "best" forex broker, some platforms consistently rank high in terms of reputation, features, and trading conditions. Here are a few reputable brokers to consider:

- FXTM: Offers a wide range of account types, competitive spreads, and a user-friendly platform.

- IC Markets: Known for its tight spreads, fast execution, and comprehensive educational resources.

- XM: Provides a variety of trading instruments, excellent customer support, and a generous bonus program.

- AvaTrade: Offers a user-friendly platform, a wide range of trading instruments, and competitive spreads.

- Exness: Known for its fast execution speeds, competitive spreads, and a variety of account types.

What to look out for in a forex broker?

Regulation and Licensing

Choosing a regulated Forex broker is paramount. A regulated broker adheres to strict financial and operational rules, offering crucial protection for your funds.

- Check the broker’s regulatory status: Ensure the broker is licensed and regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the National Futures Association (NFA) in the US.

- Look for a strong financial track record: A broker with a long history of consistent operation and a stable financial standing is more trustworthy.

- Confirm if the broker participates in a compensation scheme: This provides you with financial protection in case the broker goes insolvent.

Trading Platform and Tools

A user-friendly trading platform with essential features is crucial for successful Forex trading.

- User interface and ease of use: Choose a platform that is intuitive and easy to navigate, with clear charts, indicators, and order entry functions.

- Variety of order types: Look for a platform that offers a diverse range of order types, including market orders, limit orders, stop-loss orders, and take-profit orders.

- Real-time market data and analytics: The platform should provide access to real-time market quotes, charts, and technical analysis tools to aid your trading decisions.

- Mobile trading app: Consider a broker with a robust mobile trading app for on-the-go access to your accounts and markets.

Fees and Spreads

Lower trading costs can significantly impact your profitability.

- Spreads: Compare spreads offered by different brokers, as they represent the difference between the bid and ask prices. Lower spreads mean lower trading costs.

- Commissions: Some brokers charge commissions in addition to spreads. Be aware of any commission structures and their impact on your trading costs.

- Other fees: Check for any additional fees, such as inactivity fees, withdrawal fees, or rollover fees.

- Transparency in fees: Ensure the broker provides clear and transparent information about all fees and charges associated with their trading services.

How do I find a legit forex broker?

Look for regulation

The most important thing to look for when choosing a Forex broker is regulation. This means that the broker is licensed and supervised by a reputable financial authority. A regulated broker is more likely to be trustworthy and operate fairly.

You can find a list of regulated Forex brokers on the websites of financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Commodity Futures Trading Commission (CFTC) in the US.

- Check the broker’s website to see if they list their regulatory information.

- Look for a license number and the name of the regulatory body.

- Verify the information with the regulatory authority’s website.

Read reviews and testimonials

Reading reviews and testimonials from other traders can give you a good idea of what to expect from a Forex broker. You can find reviews on websites such as Trustpilot, Forex Peace Army, and Myfxbook. Look for reviews that are detailed and objective.

Be wary of reviews that are overly positive or negative, as they may be biased.

- Read reviews from a variety of sources to get a well-rounded view.

- Pay attention to the reviewer’s experience level and their trading style.

- Look for reviews that mention specific features or services that are important to you.

Consider the trading platform and features

The trading platform is the software that you will use to place your trades. It is important to choose a platform that is user-friendly and has the features that you need. Some important features to consider include order execution speed, charting tools, and technical indicators.

- Try out the trading platform with a demo account before you fund your account.

- Make sure that the platform is compatible with your operating system and device.

- Compare the features of different platforms to find one that meets your needs.

Frequently Asked Questions

What are the key factors to consider when choosing a Forex broker?

When selecting a Forex broker, several key factors must be taken into account to ensure a secure and reliable trading experience. First and foremost, it is crucial to prioritize the broker’s regulatory status.

A regulated broker, licensed by reputable financial authorities, provides a layer of protection for your funds and adheres to industry standards. Furthermore, consider the broker’s reputation, gauging their track record and customer feedback through reviews and online forums.

Assessing the trading platform’s user-friendliness is also essential, as a seamless and intuitive platform can significantly enhance your trading experience. Finally, the trading conditions offered by the broker, including spreads, commissions, leverage, and account types, should align with your trading style and risk tolerance.

By carefully considering these factors, you can choose a Forex broker that meets your specific needs and supports your trading goals.

What are the different types of Forex brokers available?

There are several types of Forex brokers available, each catering to different trading styles and preferences. Market makers act as counterparties to your trades, profiting from the spread between the buy and sell prices.

Electronic communication networks (ECNs) connect you directly to other traders, providing tighter spreads and faster execution speeds. Dealing desk brokers act as intermediaries, manually matching buy and sell orders.

No dealing desk brokers automate order execution, eliminating the risk of manual intervention. STP (Straight-Through Processing) brokers automatically route your orders to external liquidity providers, often offering transparent pricing and execution. Choosing the right type of broker depends on your trading strategy, risk tolerance, and preferred execution speed.

How can I find a reliable and trustworthy Forex broker?

Finding a reliable and trustworthy Forex broker requires thorough research and due diligence.

Firstly, check the broker’s regulatory status, verifying their licenses from reputable authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Commodity Futures Trading Commission (CFTC) in the US.

Secondly, examine the broker’s reputation by reading online reviews and seeking feedback from other traders. Thirdly, assess the broker’s website and platform, looking for transparency in terms of fees, trading conditions, and customer support.

Finally, consider using a demo account to familiarize yourself with the platform and trading conditions before risking real money.

What are some tips for staying safe when trading Forex?

Staying safe when trading Forex involves prioritizing risk management and safeguarding your funds.

Firstly, it’s crucial to understand the risks involved in Forex trading, as it’s a volatile market with potential for significant losses.

Secondly, never invest more than you can afford to lose and set realistic trading goals. Thirdly, utilize stop-loss orders to limit your potential losses on a trade. Fourthly, avoid trading on margin if you’re not comfortable with the risks.

Fifthly, choose a regulated broker with a proven track record. Finally, keep your trading account secure by using strong passwords and enabling two-factor authentication.