In the realm of financial trading, forex markets present both lucrative opportunities and inherent risks. For traders seeking to navigate these markets successfully, it is imperative to develop a comprehensive risk management strategy.

This article aims to guide traders through the complexities of risk management in forex trading, providing practical insights and effective techniques to mitigate potential losses while maximizing returns.

Protecting Your Capital: A Guide to Forex Risk Management

Understanding the Risks of Forex Trading

Forex trading, also known as currency trading, offers the potential for high profits, but it also comes with significant risks. The market is highly volatile, influenced by global economic events, political instability, and other unpredictable factors.

To mitigate these risks, it’s crucial to implement a solid risk management strategy.

Here are some key risks associated with Forex trading:

| Risk | Description |

|---|---|

| Market Volatility | Rapid fluctuations in currency exchange rates can lead to significant losses. |

| Leverage | Forex trading utilizes leverage, allowing traders to control larger positions with a smaller investment. While leverage can amplify profits, it also magnifies losses. |

| Geopolitical Events | Political instability, wars, and other global events can drastically impact currency valuations. |

| Economic Indicators | Economic data releases, such as inflation figures and interest rate decisions, can cause sudden market movements. |

| Counterparty Risk | The risk that your broker or trading platform may not fulfill its obligations. |

Developing a Risk Management Plan

A well-defined risk management plan is essential for successful and sustainable Forex trading. It involves setting limits, managing your emotions, and staying informed about market conditions.

Here are some key components of a comprehensive risk management plan:

| Component | Description |

|---|---|

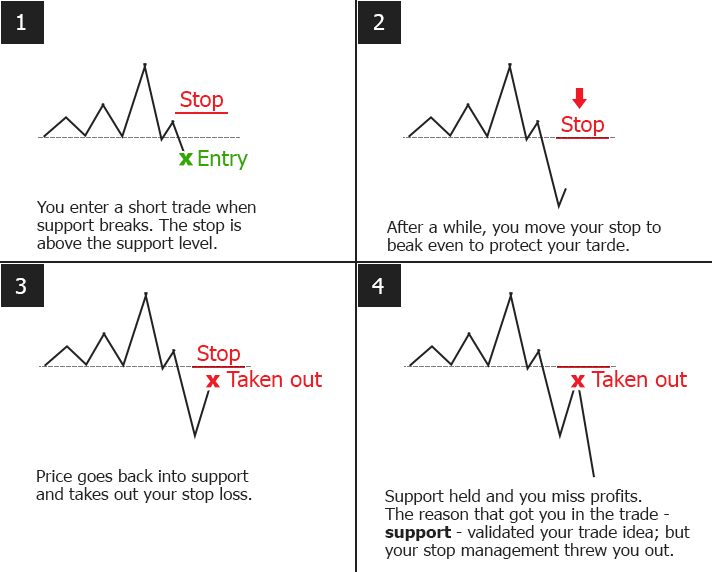

| Stop-Loss Orders | Automatic orders that close your trade when a predetermined price level is reached, limiting potential losses. |

| Risk-Reward Ratio | A measure of the potential profit compared to the potential loss on a trade. Aim for a risk-reward ratio that favors potential profits. |

| Position Sizing | Determining the appropriate amount of money to invest in each trade, based on your risk tolerance and account size. |

| Diversification | Spreading your investments across multiple currency pairs to reduce the impact of any single currency’s volatility. |

| Emotional Control | Avoiding impulsive trading decisions based on fear or greed, and sticking to your predetermined trading plan. |

Staying Informed and Adapting

The Forex market is constantly evolving, so it’s crucial to stay informed about market trends, economic events, and regulatory changes. Continuous learning and adaptability are essential for effective risk management.

Here are some ways to stay informed and adapt your risk management strategy:

| Action | Description |

|---|---|

| Market Research | Analyzing market data, economic indicators, and news events to understand market sentiment and identify potential trading opportunities. |

| Continuous Learning | Staying updated on Forex trading strategies, risk management techniques, and market analysis tools. |

| Adapting Your Strategy | Reviewing your risk management plan regularly and adjusting it based on changing market conditions and your trading experience. |

| Seeking Guidance | Consulting with experienced Forex traders, financial advisors, or mentors to gain insights and improve your risk management skills. |

What is 2% risk management in forex?

What is 2% Risk Management?

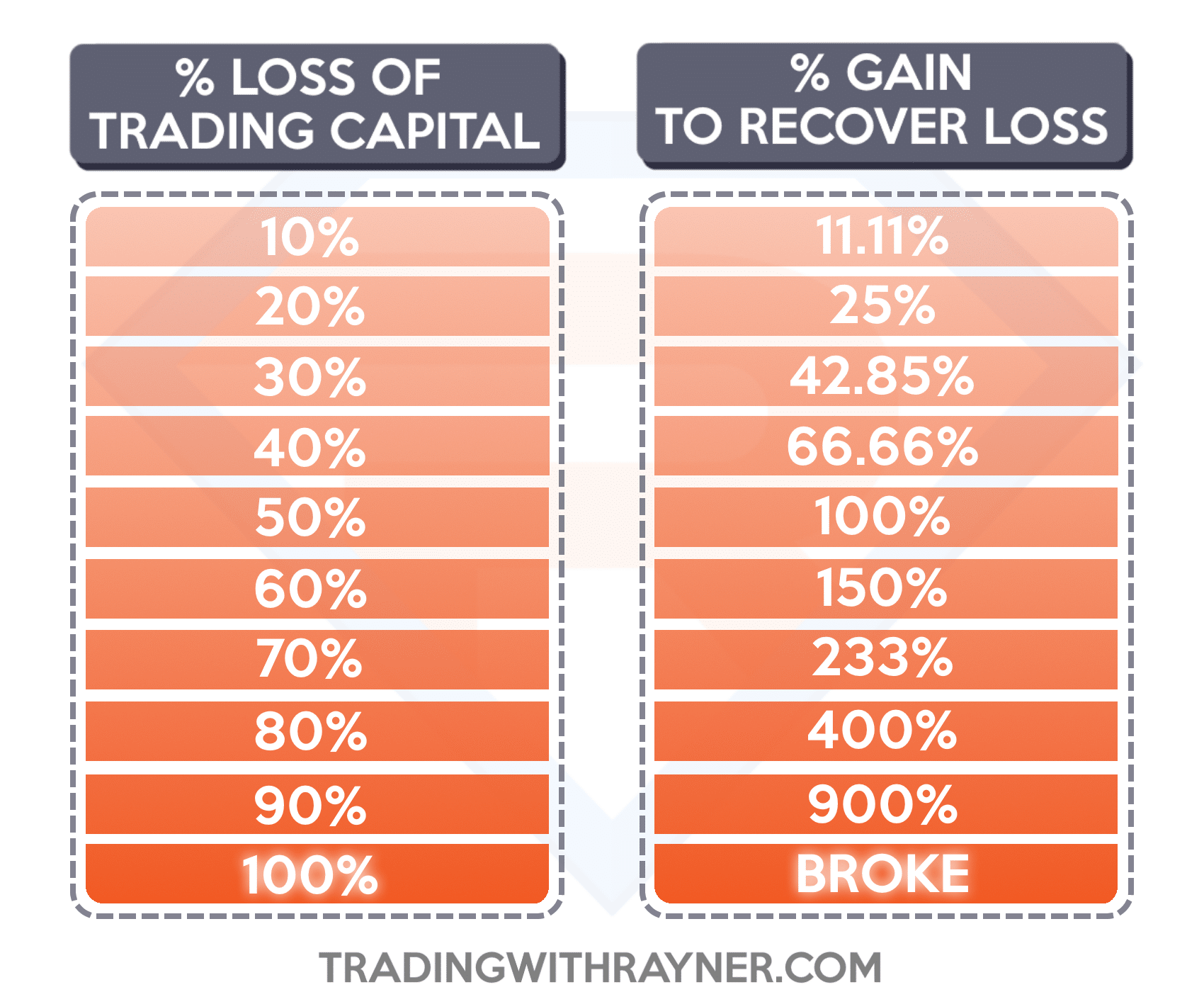

2% risk management in forex trading is a strategy where traders limit their potential losses on each trade to a maximum of 2% of their account balance. This means that if you have a $10,000 account, you should only risk a maximum of $200 on any single trade.

Why is 2% Risk Management Important?

Implementing a 2% risk management strategy is crucial for several reasons:

- Preserves Capital: By limiting losses on each trade, traders can protect their capital and avoid blowing up their account.

- Emotional Control: It helps traders maintain emotional discipline, reducing the temptation to chase losses or overtrade.

- Sustainable Trading: This strategy allows traders to stay in the market for the long term by minimizing the impact of losing trades.

- Consistent Results: Consistently adhering to 2% risk management helps traders achieve consistent results over time.

How to Implement 2% Risk Management

Implementing 2% risk management in your forex trading requires a few steps:

- Determine Your Account Balance: Know the total amount of money you have in your trading account.

- Calculate Your Risk Per Trade: Multiply your account balance by 2% to determine the maximum amount you should risk on any trade.

- Set Stop-Loss Orders: Place stop-loss orders at a level that corresponds to your 2% risk threshold. This automatically closes your position if the trade goes against you, limiting potential losses.

- Adjust Position Size: The size of your position should be adjusted based on your risk per trade and the distance between your entry price and stop-loss order.

How do traders manage risk?

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

Risk Management Strategies

Traders employ a variety of risk management strategies to protect their capital and ensure sustainable profitability. These strategies aim to minimize potential losses while maximizing potential gains.

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade. This involves considering factors like account size, risk tolerance, and the potential profit and loss of the trade.

- Stop-Loss Orders: Automated orders placed to exit a trade at a predetermined price level, limiting potential losses. Stop-loss orders act as a safety net, protecting traders from significant market fluctuations.

- Diversification: Spreading investments across different asset classes, industries, and markets. This reduces the overall risk by minimizing the impact of negative performance in any single investment.

Risk Tolerance and Risk Appetite

Every trader has a unique risk tolerance and risk appetite, which influences their trading decisions.

- Risk Tolerance: An individual’s capacity to withstand potential losses. Traders with high risk tolerance are comfortable taking on larger positions and potentially losing more money, while those with low risk tolerance prefer smaller positions and smaller potential losses.

- Risk Appetite: An individual’s willingness to take on risk. A trader with a high risk appetite might be more inclined to pursue high-risk, high-reward trades, whereas a trader with low risk appetite might focus on low-risk, low-reward trades.

Risk Monitoring and Analysis

Regular monitoring and analysis of trading performance are crucial for effective risk management.

- Tracking Performance: Keeping detailed records of trading activity, including profits, losses, and risk-reward ratios. This helps traders identify patterns, assess their risk management effectiveness, and make informed adjustments.

- Reviewing Risk Parameters: Periodically evaluating and adjusting risk parameters based on market conditions, trading strategy, and individual risk tolerance. This ensures that risk management strategies remain aligned with current circumstances.

What is the biggest risk in forex trading?

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

The Biggest Risk in Forex Trading

The biggest risk in forex trading is loss of capital. Unlike other financial markets where you may be able to limit your losses, the forex market operates on leverage, which can amplify your gains but also your losses. Even a small movement in the exchange rate can result in significant losses if you are trading with leverage.

Understanding Leverage

Leverage is a powerful tool that allows traders to control a larger position in the market with a smaller amount of capital. However, it can also amplify losses. For example, if you trade with 1:100 leverage, a 1% move against you will result in a 100% loss of your initial investment.

Managing Risk

There are a number of ways to manage risk in forex trading. These include:

- Using stop-loss orders: Stop-loss orders are designed to limit your losses by automatically closing your position when the price reaches a certain level.

- Trading with a small percentage of your capital: This helps to ensure that even if you experience a loss, it will not significantly impact your overall portfolio.

- Diversifying your portfolio: Diversifying your portfolio by trading multiple currency pairs can help to reduce your overall risk.

- Developing a trading plan: A trading plan should outline your goals, your risk tolerance, and your trading strategy. It can also help you to stay disciplined and avoid impulsive decisions.

How do you target profits in forex and manage your risk?

Profit Targeting in Forex

Profit targeting is an essential aspect of forex trading, aiming to secure profits at predefined levels. Determining profit targets involves considering factors like:

- Market Volatility: High volatility markets may require setting smaller profit targets to lock in profits quickly, while low volatility markets allow for larger targets.

- Trading Strategy: Your chosen trading strategy influences the profit target. Scalping strategies often focus on small, frequent profits, while trend-following strategies may target larger gains.

- Risk Tolerance: Your individual risk tolerance dictates the level of profit you’re comfortable securing. Higher risk tolerance can lead to larger profit targets, while lower tolerance may result in smaller targets.

Risk Management Techniques in Forex

Risk management is crucial to protect capital and prevent significant losses. Effective techniques include:

- Stop-Loss Orders: These orders automatically close a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Determine the appropriate size of your trades based on your risk tolerance and account balance to avoid overexposure.

- Diversification: Spreading investments across different currency pairs or asset classes reduces the impact of losses on a single trade.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio, where the potential profit outweighs the potential loss. A common ratio is 1:2, meaning for every $1 risked, you aim to make $2 in profit.

Integrating Profit Targeting and Risk Management

Combining profit targeting and risk management strategies creates a robust trading plan.

- Set Realistic Profit Targets: Don’t chase unrealistic gains. Establish targets based on market conditions and your trading strategy.

- Utilize Stop-Loss Orders: Protect your capital by using stop-loss orders to exit trades at predefined levels if the market moves against you.

- Monitor and Adjust: Regularly review your trading performance and adjust profit targets and risk management strategies as needed based on market fluctuations and your trading outcomes.

Frequently Asked Questions

What are the main types of risks in Forex trading?

Forex trading involves several types of risks that traders need to understand and manage. The most common risks include:

- Market risk: This refers to the risk of losing money due to fluctuations in the exchange rate of a currency pair. For instance, if you buy a currency pair that then depreciates in value, you will lose money.

- Liquidity risk: This risk occurs when you find it difficult to buy or sell a currency pair at the desired price. This can happen when market conditions are volatile or there’s insufficient liquidity in the market.

- Operational risk: This risk relates to errors or failures in the trading process, such as technical malfunctions, human mistakes, or fraud.

- Counterparty risk: This is the risk that the other party in a trade will not fulfill their obligations. This is more relevant for traders dealing with individual brokers rather than with well-established institutions.

How can I manage risk in Forex trading?

There are several key risk management strategies you can implement in your Forex trading activities. Here are some important tactics:

- Use a stop-loss order: This is a crucial tool that automatically closes your trade when a specific price level is reached, limiting your potential losses.

- Set a risk-to-reward ratio: This involves calculating the potential profit you might make versus the potential loss you could incur. Aim for a favorable risk-to-reward ratio to ensure your potential gains outweigh the potential risks.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your trades by investing in different currency pairs to spread your risk across various markets.

- Manage your leverage: Leverage allows you to control larger positions with a smaller amount of capital. However, excessive leverage can magnify your losses. Use leverage wisely and avoid taking on too much risk.

- Develop a trading plan: A well-defined trading plan should outline your objectives, risk tolerance, entry and exit strategies, and money management rules. Adhering to your plan can help you avoid emotional trading decisions.

What are some common mistakes to avoid in risk management?

While risk management is crucial for success in Forex trading, many traders fall prey to common pitfalls. Be aware of these mistakes to avoid them:

- Ignoring risk altogether: Never underestimate the importance of risk management. Ignoring risk can lead to significant losses and even financial ruin.

- Overtrading: Avoid making too many trades, especially if they are based on emotional impulses rather than a well-defined plan. Overtrading can lead to impulsive decisions and increased risk.

- Not setting stop-loss orders: Failure to utilize stop-loss orders can result in substantial losses if the market moves against your position.

- Chasing losses: Trying to recover lost money by taking on more risk can lead to a vicious cycle of losses. Stay disciplined and avoid this trap.

How can I improve my risk management skills?

Developing effective risk management skills takes time and effort. Here are some strategies to enhance your approach:

- Learn from experienced traders: Read books, articles, and forums, and engage with seasoned Forex traders to gain insights into best practices.

- Practice risk management techniques: Use demo accounts to test different risk management strategies without risking real money. This will help you refine your approach before entering live markets.

- Track your trades and analyze your performance: Keep a detailed log of your trades, including your risk management decisions, to identify patterns and areas for improvement.

- Continuously learn and adapt: The Forex market is dynamic and constantly evolving. Stay updated on market trends, news, and events that could impact your trades and risk profile.